Roofing Contractor 2017 State of the Industry Report

Sponsored by GAF

Roofing Contractor's State of the Industry Report and Survey 201 is sponsored by GAF.

Photo courtesy of Carlson Roofing Co.

Coatings and solar sales continue to be important for commercial contractors. Photo courtesy of Star Roofing.

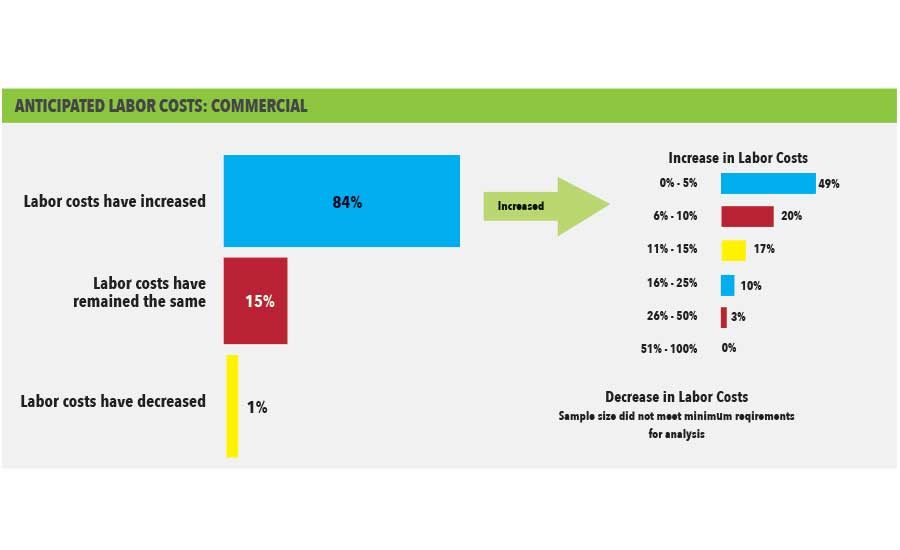

Anticipated Labor Costs: Commercial

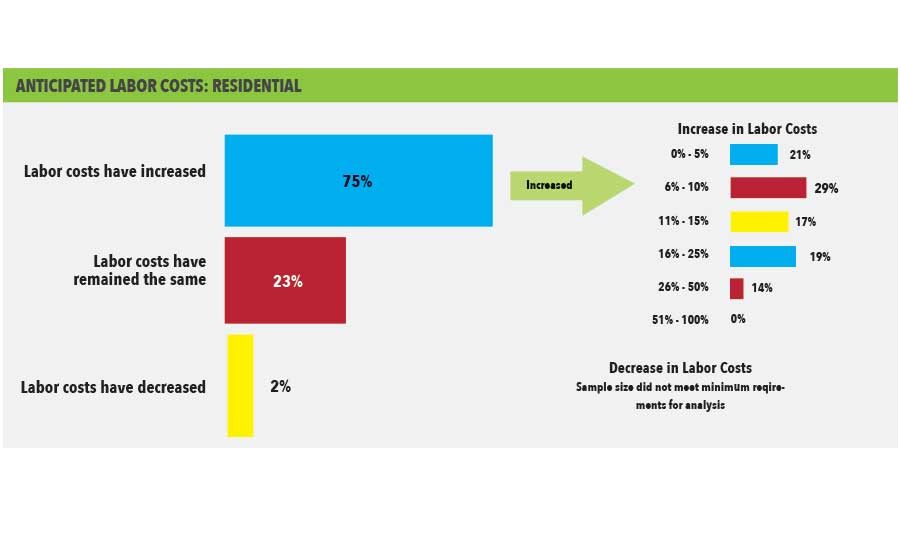

Anticipated Labor Costs: Residential

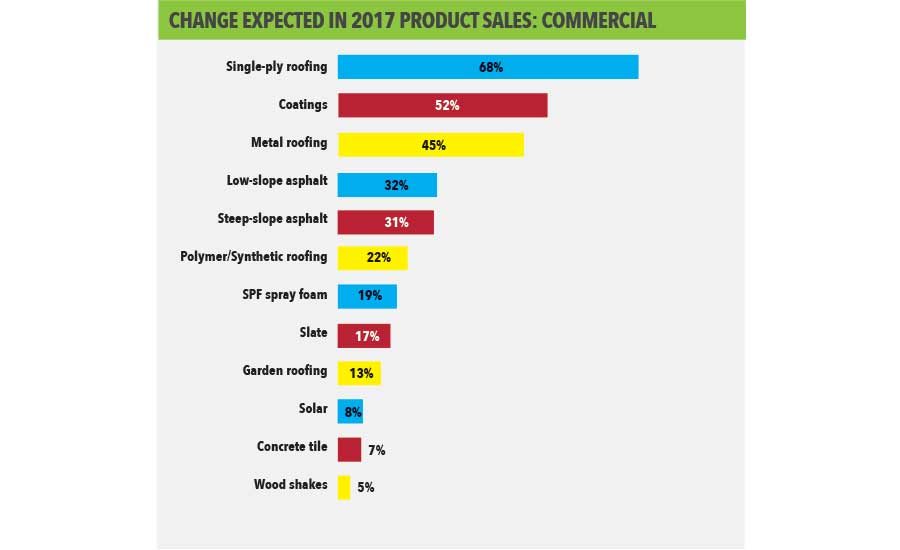

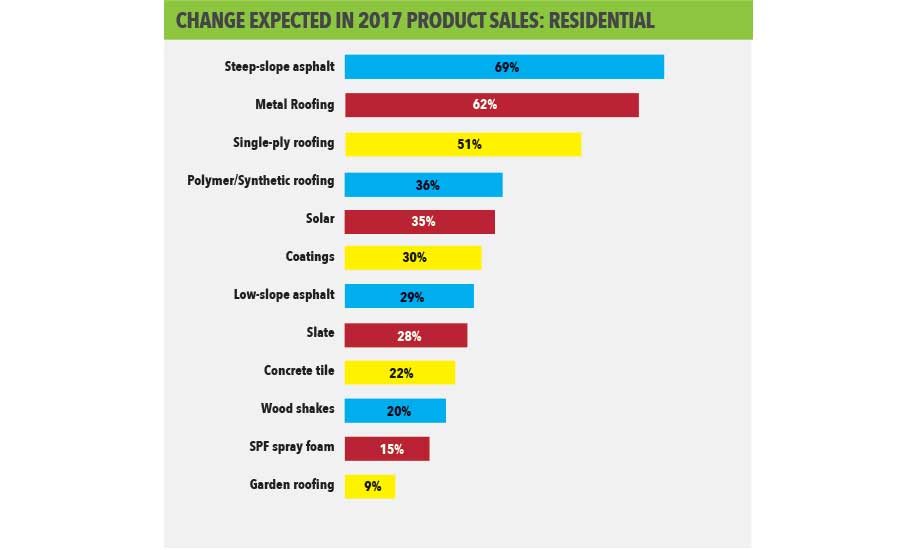

Change Expected in 2017 Product Sales: Residential

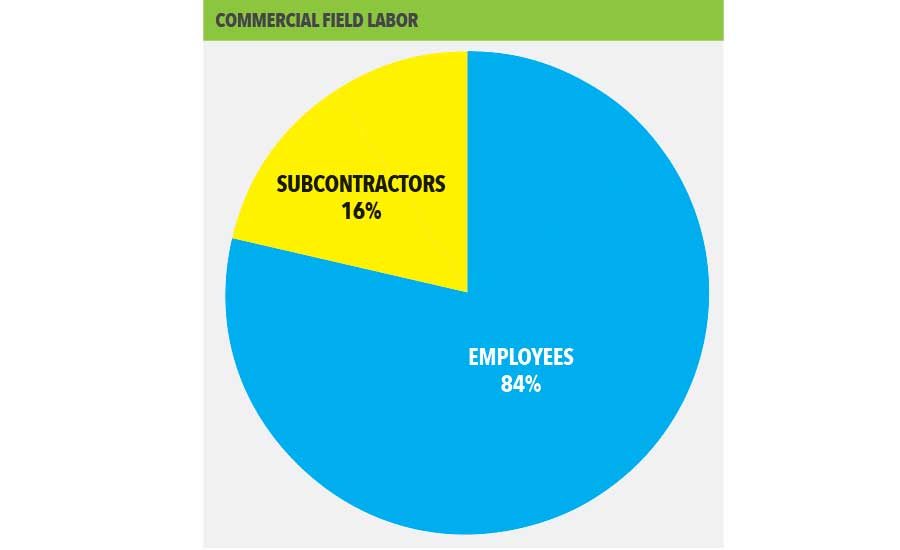

Commercial Field Labor

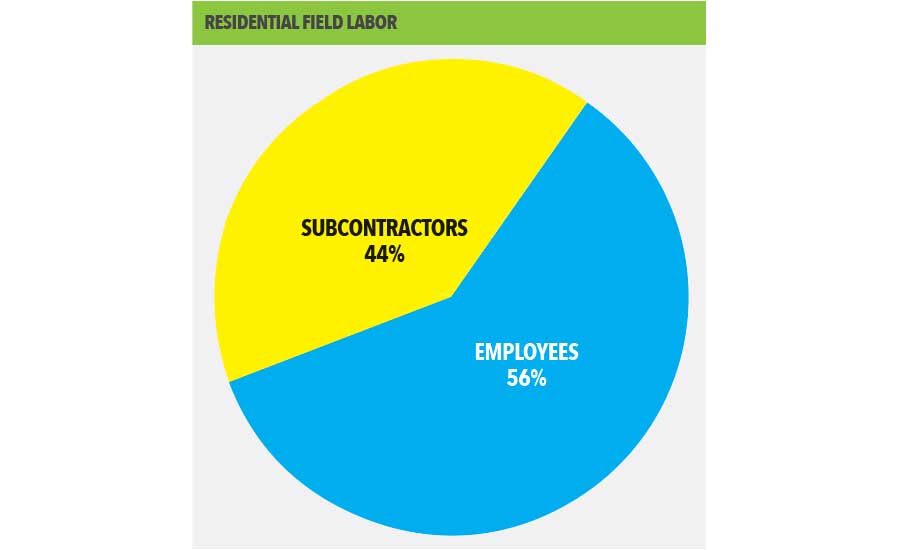

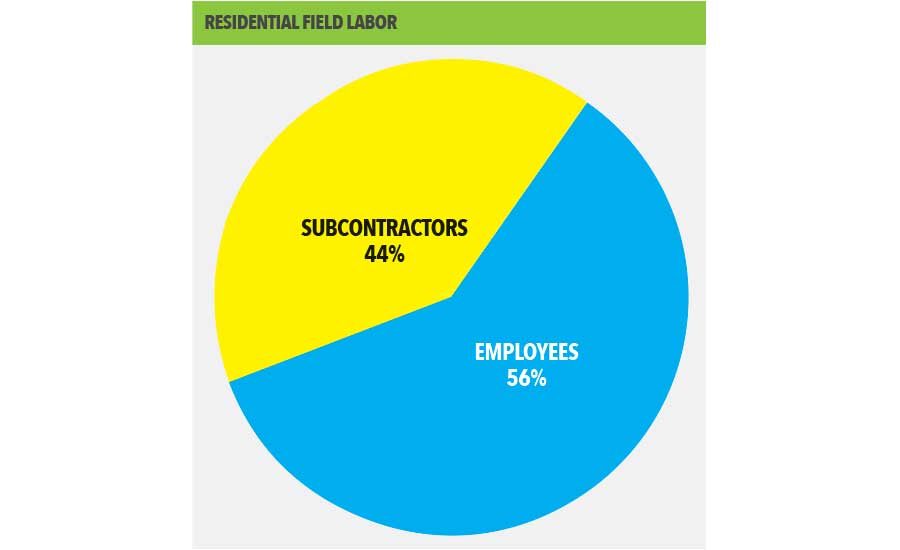

Residential Field Labor

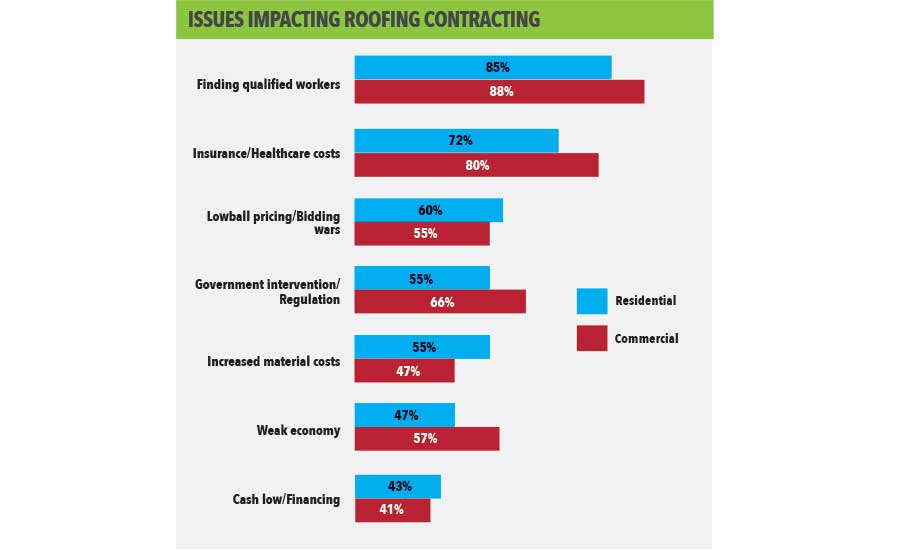

Issues Impacting Roofing Contractors

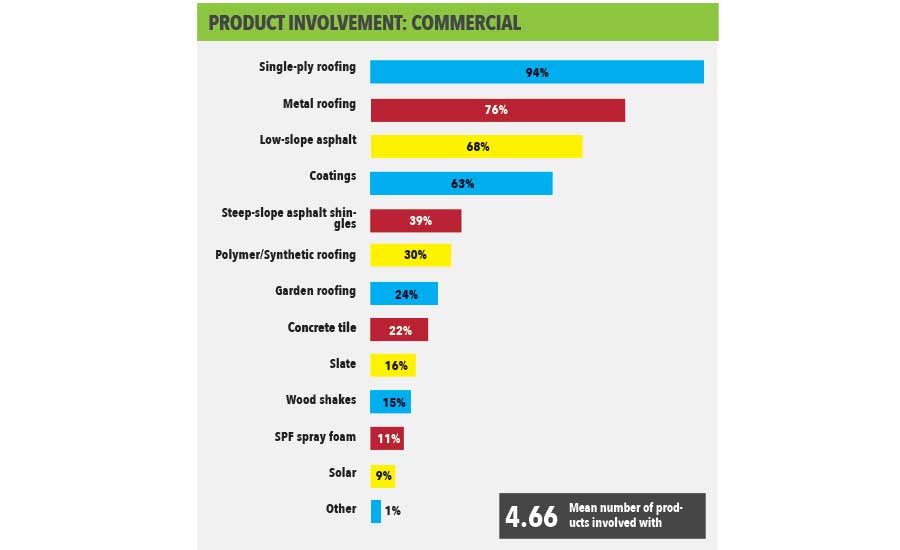

Product Involvement: Commercial

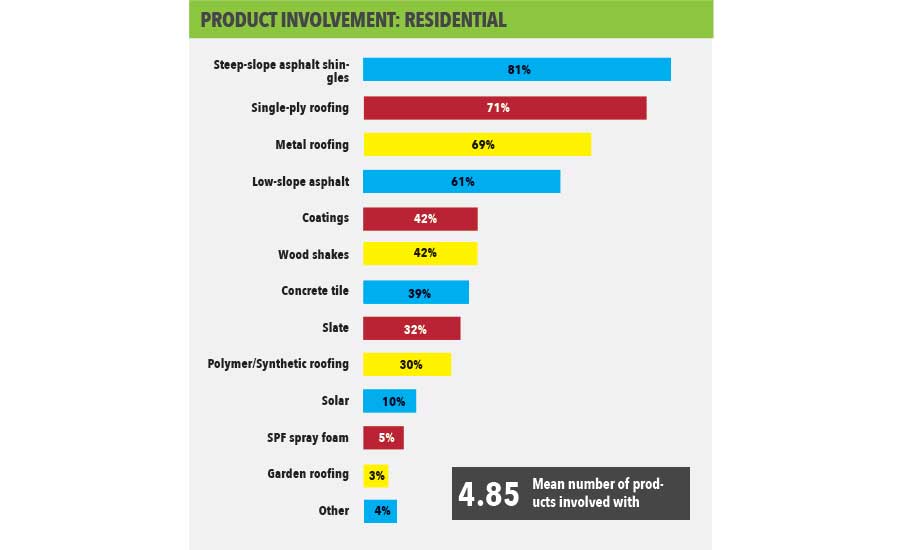

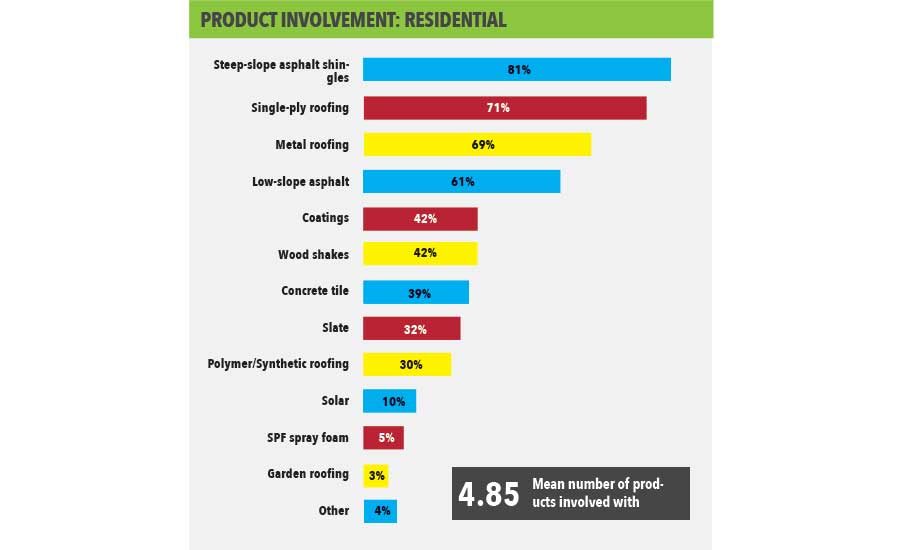

Product Involvement: Residential

The past year in roofing was one of continued optimism in the recovering economy sprinkled with some frustration over government regulation, doubt about attempts to solve the continued workforce issue, and trepidation — followed by some relief — once the dust from the 2016 presidential election settled.

For the ninth consecutive year, Roofing Contractor reached out to our readers — roofing industry professionals from different segments of the business around the country — to help put it all in perspective. With the help of GAF and the experts at BNP Market Research, the research wing of BNP Media, RC’s parent company, the following provides a look into what a year it was, and what most hope the coming year to be — based on a mixture of raw data and the insights of industry leaders.

Click here to see the 2018 State of the Industry

The annual survey again targeted roofing contractors across the United States from Nov. 8-22, 2016.

We asked about sales volumes for 2016; anticipated sales for 2017 and the next three years; trends among multiple product categories; and key challenges facing roofing contractors in their markets. The survey also included questions on several different topics, such as plans for expansion, capital expenditures and the use of new technology to help invigorate and improve their businesses. This year, we added several questions pertaining to labor issues, safety and OSHA fines, healthcare and contractor certification efforts.

Respondents included Roofing Contractor subscribers and a sampling of contractor members from the Midwest Roofing Contractors Association (MRCA) and the Western States Roofing Contractors Association.

Full disclosure: RC provided 10 $50 gift cards to randomly-selected respondents that completed the entire survey.

As in past years, respondents to the study were typically high-ranking officers or executives of their companies. More than 60 percent listed their title as corporate or executive management in both the commercial and residential sectors. Another 20 percent identified themselves as general management.

Companies that derived at least 70 percent of their business revenue from residential work were classified as residential, and the same standard applied to commercial roofing contractors that responded to the survey. In the residential sector, companies had an average of 25 full-time employees and reported more than $7 million in gross annual sales. More than one-third of respondents (33 percent) indicated the majority of their business revenue stemmed from residential roof replacement.

In the commercial realm, companies averaged 56 full-time employees and more than $8.3 million in sales. Less than one-third (27 percent) attributed the majority of revenue to commercial roof replacement, while 15 percent selected new construction and another 12 percent noted commercial repair.

Residential Sales Spurt

By most accounts, the past year was strong in terms of sales and continued momentum built in the final fiscal quarters, which led to increased optimism about 2017 and beyond. Roughly 69 percent of residential roofing contractors indicated they expected revenue to increase this year, which is just slightly higher than the 67 percent of those that anticipated revenues to increase from 2015 to 2016.

“The 2016 roofing season contained very few, if any surprises,” said Rick Hebert, director of training and development at Sherriff-Goslin Roofing Company in Kalamazoo, Mich. The company offers a mix of residential and commercial roofing services and creates an annual forecast of both sales and production numbers based on goals and insights from branch managers.

“In 2016, we hit our projected numbers in both areas,” he continued. “Sales and production numbers were up approximately 7 percent from a year ago.” Though specific market conditions helped dictate their success, Hebert also attributed the growth to enhanced training for sales and production staff in recent years.

In other parts of the country, namely the Southwest, severe weather was a significant factor. The National Oceanic and Atmospheric Administration (NOAA) reported 20,237 significant storms in 2016. That’s a slight increase from 2015 (19,172) but the highest amount in roughly three years — which anecdotally was enough to cause some disruption in the shingle supply chain.

Though storms remain largely unpredictable, roofing contractors and manufacturers don’t anticipate the storm market to lose steam in 2017.

“This was one of the largest storm years we’ve had in the past four years, and the demand for roofing was definitely up,” said Keith Lowe, vice president of sales for IKO. “We anticipate this momentum to continue into 2017, as we don’t expect storm activity to slow down.”

The overwhelming majority of survey respondents (nearly 75 percent) in the residential roofing category said they anticipate revenue to increase through 2020. Fueling that optimism, in part, are relatively-low interest rates and an uptick in housing estimates.

The final numbers are still under analysis, but the National Association of Home Builders (NAHB) projects 1.16 million total housing starts in 2016. That’s up 4.9 percent from the previous year’s total of 1.11 million units.

Single-family home production is expected to rise 10 percent in 2017 to 855,000 units and increase an additional 12 percent to 961,000 next year. The NAHB also projects multi-family housing starts to stand firm at roughly 400,000 units, slightly ahead of last year’s pace.

Commercial Caution

While 76 percent of commercial roofing contractors said they’re optimistic about roofing sales to increase over the next three years, just 61 percent anticipate revenue to increase this year over 2016. That’s a less promising outlook than residential contractors, and a full 10 percent fewer than commercial contractors that expected sales to increase from 2015 to 2016.

Part of that reduced optimism is due to broader economic forecasts that call for modest — most likely single-digit growth — in the private, non-residential segment of the construction market this year.

“There will be different opportunities with office construction maintaining nice growth. However, medical facilities may only see modest growth, while retail and warehousing may be slowing,” said Randy Adams, chairman and CEO of R. Adams Roofing, Inc. in Indianapolis. “With the possibility of tax changes under the Trump administration, and infrastructure spending increasing, we will have a mixed outlook during 2017.”

Other commercial roofing contractors indicated they were still confident that annual projections would reflect momentum gained in the final quarter of 2016. Roofing juggernaut CentiMark reported annual national sales exceeding $600 million for the first time and retained its top spot on Roofing Contractor’s Top 100 Roofing Contractors list for the fifth-straight year in 2016. The strongest growth occurred in the southeast, northern and western United States, and some parts of Canada, though the strength of the American dollar and eroded conversion rate reduced some profits.

Company officials said investment in company infrastructure — namely improvements to technology, software and an enhanced Customer Relationship Management (CRM) program were key factors.

“Significant investments in technology allow us to further improve the customer experience,” said Tim Dunlap, CentiMark president and COO. He also noted that the company expanded into a new area — steep slope roofing. “We found ourselves moving in this direction at the request of our current customers who were looking for a single company that can handle both their low and steep slope needs.”

The overall projections and high consumer confidence demonstrated in 2016 and early 2017 have roofing manufacturers looking forward to this year.

“We expected modest market growth and were pleasantly surprised to see the market growth turn out as strong as it did (in 2016),” said Jennifer Ford-Smith, director of single-ply and marketing for John Mansville. “The health of the industry is very strong, the demand is driven by a strong reroofing market and an exceptional new construction market.”

Products

As the majority of residential roofers that responded to the survey indicated they were dependent on roof replacement for revenue, it’s no surprise that steep slope asphalt shingles were the dominant product of choice at 81 percent. Single-ply roofing (71 percent), metal roofing (69 percent), low slope asphalt (61 percent) and coatings (42 percent) rounded out the top five.

Nearly 30 percent selected polymer/synthetic roofing, and 10 percent or less indicated they used solar, SPF spray foam or garden roofing as business drivers, the data showed. That’s relatively similar to previous survey responses from residential roofing contractors, and consistent with what shingle manufacturers said they found in their own projections.

“The roofing business continues to have strong fundamentals and is positioned for continued growth,” said Brian King, vice president of marketing, roofing and asphalt for Owens Corning. “In particular, the asphalt shingle category continues to provide the most benefit to the contractor for the lifetime cost of a roofing system — pure value.”

Officials with IKO said they also expect asphalt roofing shingles to remain the top roofing material used across North America by a large margin for years to come. The company geared future investments to meet the demand, namely with the construction of a new 250,000 square-foot manufacturing plant in Hillsboro, Texas that will serve all of the Southwest. Lowe said the construction crews broke ground in 2016 and once complete, IKO’s ninth North American shingle plant will solidify its footprint in the U.S.

They’re not alone in backing up the perceived optimism with major dollars.

Global building-materials conglomerate Saint-Gobain cemented a long-term investment in U.S. manufacturing in 2016 with the completion of a CertainTeed shingle plant in Jonesburg, Mo. The $100 million facility closed a manufacturing hole in CertainTeed’s national roofing distribution chain and keeps their products closer to market. But officials also said they made the investment with the hope of making positive changes by stimulating local and state economies via tax revenues and job opportunities.

“This modern manufacturing plant symbolizes growth for our employees — to learn new skills, — to put down roots, buy homes, invest in schools, — and to create a life here based on opportunity,” said Saint-Gobain CEO Pierre-Andre de Chalendar at a grand opening ceremony last June.

More than 64 percent of residential contractors that offer steep slope asphalt reported sales increases in 2016, and 69 percent said they expect increases to continue this year.

“We saw a very healthy business environment for both reroofing and new construction (in 2016),” said Reed Hitchcock, executive vice president of the Asphalt Roofing Manufacturers Association (ARMA). “Lenders and rates seem to have been favorable to home and building owners, so deferred maintenance and repair issues were addressed — a good thing for the owners and the industry alike.”

Metal roofing was next on the list for increased sales in 2017 at 62 percent, followed by single-ply (51 percent). Making a push for the top five was solar, which at 35 percent leapfrogged both coatings and low slope asphalt, when compared to previous surveys.

In the commercial sector, nearly all roofing contractors (94 percent) indicated they were involved with single-ply roofing. More than 76 percent selected metal, followed by low-slope asphalt (68 percent) and coatings (63 percent).

While the bituminous membrane market share continued to diminish, it wasn’t as rapid as anticipated, some industry experts said.

“2016 was somewhat surprising as we didn’t see the erosion (due to single-ply's growth, particularly TPO) as significant, and in some cases we saw growth, such as in the modified membrane category,” Ford-Smith said. “TPO will continue to grow as it is the low-cost leader and the market continues to gain confidence in its performance in the long run. We estimate that it’s over 45 percent of the major commercial membrane market.”

Leaders in roofing product distribution agreed.

“TPO continues to grow and has maintained its position as the most popular product in this space,” said Mike Jost, vice president of operations for ABC Supply Co. Notable growth occurred in both PVC, insulation and silicone products in 2016. “With building owners looking for better energy performance, the sale of roof deck insulation continues to grow as well. We expect these trends to continue in 2017.”

Ford-Smith also said the EPDM market was relatively flat, but still remains the second largest membrane in the market.

Foaming Up

There were no surprises among the top five of commercial products expected to produce sales gains in 2017 as single-ply (68 percent), coatings (52 percent), metal (45 percent), low slope asphalt (32 percent) and steep slope asphalt (31) ranked identically to past surveys. However, contractors anticipating spray foam sales to jump in 2017 increased to 19 percent. That pushed it ahead of anticipated gains in solar, concrete tile, garden roofing and slate when compared to the 2016 report.

Product enhancements and greater attention to environmental concerns made a difference for Lapolla Industries, which experienced record sales in 2016, officials said. The company fully commercialized a 4G version of roofing foam that reportedly displays greater yield, better R-value and ease of use by roofing contractors.

“The product is known for its environmental protections, which include the complete elimination of ozone depletion potential and dramatic reduction in global warming impacts,” CEO Doug Kramer said. “These product innovations are helping to drive growth among our roofing line and overall sales growth.”

The product’s widespread use in the insulation sector over the past decade continues, and as officials look ahead to 2017, they expect the SPF marketplace to grow as the sustainable building movement evolves. Code-mandated improvements in energy efficiency and reduced building air leakage will likely remain the primary drivers, said Rick Duncan, technical director of the Spray Polyurethane Foam Alliance (SPFA).

For example, California’s new Title 24 requirements and the International Code Council’s International Conservation Code have already driven product sales upward. Even though SPF got its initial start decades ago as a roofing material, it remains largely on the peripheral of the market. According to our survey, single-ply roofing, on average, accounts for more than half of all commercial contractor’s sales. Spray foam, garden roofing, concrete tile, wood shakes, slate and solar make up just a combined 5 percent of all commercial sales combined.

While installations of roofing applications haven’t experienced the same explosive trajectory as insulation applications over the past few years, Duncan said growth in roofing applications has nonetheless continued at a steady pace, catalyzing both the sale and use of related coatings used in conjunction with it.

“The steady growth of SPF roofing and related coatings is being fueled by many of the drivers pushing insulation applications,” he explained. “However, demand is also influenced by SPF’s affordable price point and performance capabilities, which, for roofing, includes both a protective roofing material and high-performance insulation.”

Roofing contractors in both the residential and commercial arenas are also doing a better job of educating themselves along with facility managers and property owners on the benefits of spray foam.

“The change to more energy efficient products is a tough battle because there is a cost differential and it may be a struggle moving forward,” said Jack Henderson, president of DCI Products. “It is absolutely about education of the roofing industry and extending that knowledge.”

Specifically for spray foam, contractors are notably emphasizing how it can provide a seamless, continuous layer over the top of the structure that performs as a vapor retarder, water resistant barrier, air barrier and thermal insulator.

SPF is also versatile and durable, boasting a compressive strength of 40 to 60 pounds-per-inch. The high-adhesion material withstands inclement weather well and has performed well in storms including hail, high winds, and driving rain. Duncan said it can provide a rooftop lifespan of more than 50 years with regular care and maintenance of the coating system, which pinpoints SPF’s importance to the coatings marketplace.

Capturing Coatings

As noted earlier, nearly 63 percent of commercial roofing contractors said they used coatings, and 40 percent indicated an increase in coatings sales in 2016. Looking deeper into the survey data, roughly a quarter of contractors indicated coatings are important to their overall business model, and most commonly because coatings provide more business opportunities and a lower-cost alternative for building owners.

As a roofing material, SPF must be protected with a covering to prevent surface degradation caused by UV exposure, mechanical wear and other weathering processes. The material can be coated with a variety of elastomeric coatings, including acrylic, silicone, butyl rubber, polyurethane and polyuria.

Two more commonly used coatings with SPF are acrylic and silicone based. Acrylics are easy to use, offered at a lower price point and currently used in a larger percentage of SPF roof systems, Duncan explained. The single-component coatings are water based, allowing for easy clean-up. They resist weathering and have a high moisture vapor transmission rate. Quick setting versions tend to skin faster than standard versions. There are also high-tensile versions that perform better under duress. Acrylics are generally available in white, tan, or gray, and almost any color may be provided through a custom tinting process.

“Sales of silicone based coatings for application over SPF are growing rapidly due to exceptional weather resistance, the ability to withstand extreme temperature changes and the retention of physical properties,” Duncan said.

These coatings are available as single-component materials, have high moisture vapor permeability and are available in white, tan, gray and dark gray, and potentially other earth tones.

While accurate predictions for coatings sales are difficult to project, Duncan said it’s safe to assume that silicone and acrylic based coatings will experience the highest sales and application volume for use alongside SPF roofing this year.

“Logic follows that steady growth in SPF roofing will spur the increased use and sales for complementary coatings,” he said.

Playing Politics

While Lapolla, which continues to be a global leader on combating Ozone depletion, and others made strides to improve the overall environmental impact of their products, the roofing industry is expecting major changes to ‘green’ regulations under Donald Trump’s presidency. There’s also widespread hope that a president from the construction business would likely favor legislation, deregulation and tax benefits that help businesses, and help grow the construction trades, in particular.

“It’s fantastic! It’s game-changing GOOD!” said DCI Products’ Henderson.

Executive orders enacted by the Obama administration will be the initial targets by both the Trump administration and Trump’s pro-business cabinet appointees, said political consultant Craig Brightup, of the Brightup Group. “It signals an end to the deluge of regulations that have been smothering SPFA members and roofing contractors since 2009. Anti-business regulations will be rolled back,” he said.

The Trump administration is also expected to team up with the Republican-controlled congress to stall or even mothball enforcement on certain regulations through the budget appropriations process.

Repealing certain regulations can occur via the Congressional Review Act, which gives lawmakers 60 days from a relation’s adoption to file a resolution of disapproval, Brightup explained. It was last used successfully in 2001 to stifle OSHA’s ergonomics standard.

The following business regulations specifically will likely be on the chopping block:

The Labor Department’s Overtime Rule; the Fair Pay and Safe Workplaces Rule for federal contractors; OSHA’s Electronic Reporting of Injuries and Illnesses Rule — with its anti-retaliation “whistleblower” provision; and OSHA’s Silica Rule, which will likely be delayed until 2018, Brightup said.

The impact will be felt across all segments of the industry.

“We expect the results of the election will drive continued interest and activity in mergers and acquisitions across the industry, and are already seeing a pick-up in inbound opportunities,” said Dan Tinker, president and COO of SRS Distribution Inc. “Although interest rates have increased, financing remains readily available, which should result in another active and exciting year in 2017.”

Sherriff-Goslin’s Hebert said voter fatigue had a direct impact on business in 2016 and he’s thankful the contentious contest is over.

“We believe that having the national election behind us will bode well for roofing and home improvement contractors,” he said. “Homeowners were inordinately preoccupied with the political climate in 2016 and moving past that will be a benefit for spending money on home projects in 2017.”

Workforce

That’s good news for the industry, assuming roofing contractors can find — and keep — the right number of skilled workers to complete the jobs. Labor issues again emerged as the leading issue impacting roofing contractors around the country. Eighty-five percent of residential contractors said finding qualified workers was their chief concern, followed by healthcare costs (72 percent) and lowball bidding (60 percent).

Roughly 88 percent of commercial roofers said a qualified workforce was the industry’s biggest challenge, followed by healthcare (80 percent) and government regulation (66 percent).

“Our challenge over the recent past is identifying and hiring individuals who are capable of successfully completing E-verification, background checks, and drug screens. These are the minimal criteria we must meet to work for most corporate clients,” said Adams, a former MRCA president, and most recent recipient of the James Q. McCawley Award — the organizations highest honor given annually for longstanding devotion to the roofing industry.

Adams said his company has turned internally to help develop leadership and other skills among current employees that want to advance their careers.

Other companies big and small are doing the same, but multiple roofing contractors said recruitment efforts must improve to make a significant difference industrywide. The situation is urgent, as worker shortages have a direct, negative impact on overall costs, quality, safety and project delays, Dunlap said.

“There are good workers out there,” he said. “Roofing contractors really have to step outside the box and come up with new and fresh recruitment ideas. Hiring field recruiters and having boots-on-the-ground recruiting can be very beneficial in this industry.”

Although there’s no easy solution, manufacturers and distributors are actively working with their contractors to head-off the workforce issue by providing resources and training.

“Education and training should be the focus for contractors looking to succeed in today’s challenging environment,” Jost explained. “Contractors can focus on running increasingly more efficient businesses and doing more with less.”

What’s Next?

While the optimism about 2017 is palpable in both the survey data and company responses from the contractor level to major manufacturers, some are taking a wait-and-see approach when it comes to evaluating anticipated increases in material costs and interest rates, as well as changes in the White House.

“It’s difficult to speculate on if or how any of these factors are going to impact in the industry,” said King. “Owens Corning leaders know that 2017 will bring economic factors and industry challenges unique to this time and often unique to regions of the country. We’ll work with the industry contractors and suppliers to meet these challenges and help our customers be successful, in any market conditions.”

Manufacturers and industry organizations must also stay vigilant to hold the Trump administration to its campaign promises while at the same time combat uninformed regulations and building code enforcement.

“Our industry needs to continue to educate officials about our products and about how roofing system components interact with one another and with the environment,” Hitchcock said. “And we need to continue to push back on flawed codes or faulty logic behind code proposals.”

One thing is certain: Change is coming, both externally and within the industry. Our survey respondents, in general, said that’s positive for roofing. Yet how that’s viewed depends on one’s outlook.

“The industry is getting more and more professional,” said Jim Ziminski, president of Able Roof/Mr. Roof, RC’s 2016 Residential Roofing Contractor of the Year. “The quality of individuals, the quality of companies and things they’re doing to improve their businesses with technology is evolving at a rapid pace now, where in years past it probably lagged behind other segments of the building trades a little bit. It’s progressing and that’s exciting.”

Editor's Note: This story was updated to reflect the slower than expected erosion of bituminous membrane's market share in Jennifer Ford-Smith's comments above.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!