Truths About The Rivalry Between Contractors and Consultants

In rivalries, the two sides don't like each other. And, that's not just true of the teams on each side of the rivalry - it's also true of the friends and fans that support them. Remember back to high school or college, and the feelings you had about rival sports teams? Think of professional sports, and there may very well be a team that you love to hate.

In rivalries, the two sides don't like each other. And, that's not just true of the teams on each side of the rivalry - it's also true of the friends and fans that support them. Remember back to high school or college, and the feelings you had about rival sports teams? Think of professional sports, and there may very well be a team that you love to hate.

Rivals and their supporters often complain about each other. They say nasty things about each other. They have jokes that poke fun at each other. They compete with each other. However, sometimes, rivals even respect each other, and the competition creates a healthy tension that actually makes each side better. Anyone who has been exposed to the roofing industry knows that there has been a longstanding and often intense rivalry between roof consultants and roofing contractors. However, there is a legitimate question that should be asked: Is it a respectful rivalry that makes each group better, or is a bitter rivalry without respect in which both sides attempt to tear each other apart?

I feel personally blessed to be in the roofing industry. Over the past 10 years, I've met with literally thousands of contractors, consultants and property owners involved in the industry. During that time, I've witnessed an industry that is increasingly filled with people who contribute to "raising the bar," which results in an industry that we can all be even more proud of.

While the perception outside of this industry (and sometimes inside it, too) is that the roofing profession is "filled with convicts and scam artists," I'm continuously amazed at the passion and dedication of so many people I meet. Even with these improvements, I constantly hear examples of the rivalry between contractors and consultants and the impact it has on the industry.

A few years ago, I found kindred spirits interested in the relationship between contractors and consultants and the implications for the industry. Rick Damato, editorial director for Roofing Contractor magazine, and Kristen Ammerman, executive editor of Interface, a magazine published by the Roof Consultants Institute, both wanted to explore this issue, too. Comprehensive support came from a host of people from both magazines and resulted in a study that was conducted in 2003 to explore the perceived "feud" between contractors and consultants. The purpose of that study was to gain insights from contractors and consultants about how they feel about each other and suggest recommendations that might lead to improvements within the industry.

What did we learn from the 2003 study? In articles I wrote in both Roofing Contractor and Interface, I concluded from that initial research that there is a rivalry between consultants and contractors, but, in general, there is mutual respect between the two professions. Yes, there is evidence of unfair generalizations about one another's negative effect on the industry, but below the surface there is mutual respect. Despite minor annoyances, interdependence between the professions is evolving, and overall perceptions of the quality and value of both groups are generally favorable.

So Rick, Kristen and I talked about a year ago and wondered - have things changed? Is the continued growth, sophistication and consolidation of property management, distribution, consultants and contractors leading to greater interdependence between the contractor and consultant professions - or are things getting worse?

So, in the early fall of 2005, we decided to essentially repeat the initial 2003 study. We invited about 900 Roof Consultant Institute members and about 1,500 roofing contractors subscribing to Roofing Contractor to participate through a direct mail survey format.

The response rate was 28 percent for consultants and 16 percent for contractors, for an overall 20 percent response rate. By industry standards, this is a healthy response rate.

This article shares the results, analysis, and comparisons demonstrating trends from the previous study, as well as some thoughts and suggestions to help professional contractors improve their businesses.

Both consultants and contractors view experience as the most important factor for a building owner to consider when choosing a roofing professional. (See Tables 1 and 2.) Client lists and credentials are the next most important criteria suggested by respondents from both professions. In general, consultants view credentials as more important than contractors do when choosing a consultant; conversely, contractors put more weight in client lists overall than consultants do. These attitudes are relatively similar to those reflected in the 2003 study.

When asked what attribute was the most important factor building owners should consider when choosing a contractor, 51 percent of consultants and 57 percent of contractors responding to the survey point to experience as the most important criterion. (See Table 1.) Both consultants (17 percent) and contractors (36 percent) believe the contractor's client list is the second most important attribute to consider when choosing a contractor. Credentials emerged as the third most important factor for both groups, with 12 percent of consultants and 4 percent of contractors responding that credentials were the most important attribute for building owners to consider.

The attitudes of consultants in this survey were similar to those in the 2003 study, but the results for contractors in the two studies differed. Specifically, compared to 2003, contractors in the 2005 study were less likely to rate experience as most important (the 2005 response of 57 percent was down 6 percent from the 2003 total of 63 percent), more likely to rate the client list as the most important factor (the 2005 response was up 16 percent from 2003's 20 percent); and less likely to rate credentials as the most important attribute (the 2005 response was 4 percent, down from the 2003 survey's 17 percent).

The attitudes of consultants in this survey were similar to those in the 2003 study, but the results for contractors in the two studies differed. Specifically, compared to 2003, contractors in the 2005 study were less likely to rate experience as most important (the 2005 response of 57 percent was down 6 percent from the 2003 total of 63 percent), more likely to rate the client list as the most important factor (the 2005 response was up 16 percent from 2003's 20 percent); and less likely to rate credentials as the most important attribute (the 2005 response was 4 percent, down from the 2003 survey's 17 percent).

Conversely, when asked what attribute was the most important factor for building owners to consider when choosing a consultant, experience again emerged as the most important factor - although, in this case, experience was split into two categories: "years of experience as a qualified roof consultant" and "past experience as a roofing or building contractor." Combining the totals for both of these responses, 51 percent of consultants and 68 percent of contractors believe that experience is the most important criterion to consider when choosing a consultant. (See Table 2.) However, consultants believe that experience as a roof consultant was a more important factor (38 percent), while contractors believe that a consultant's past experience as a contractor was more crucial (40 percent). Credentials are more important to consultants (22 percent) than contractors (12 percent). A minority of respondents from both professions viewed client lists as the most important criterion (14 percent of consultants, 16 percent of contractors).

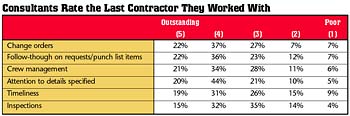

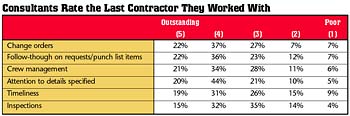

Consultants believe that contractors perform best on attention to details in specifications (64 percent of consultants gave contractors a 4 or 5 in this area). Performance by contractors on change orders was viewed as unsatisfactory or poor by 14 percent of consultants, who gave contractors a 1 or a 2 in this category. The consultants' last experience with contractors related to follow-through on punch lists was considered unsatisfactory by 19 percent, but this figure was down from 21 percent in the 2003 study. Seventeen percent of consultants believe contractors do not manage their crews well, but this was an improvement compared to the 2003 study, where 21 percent found crew management unsatisfactory. The study shows the biggest areas for improvement by contractors are in timeliness (24 percent gave contractors a 1 or 2 in this area, compared to 29 percent in 2003) and contractor quality of inspections (18 percent received a 1 or a 2, an improvement of 6 percent versus 2003 statistics).

When contractors were asked to rate the last consultant they worked with, consultants received the best ratings in communications with contractors and in specification and details, with 65 percent and 64 percent receiving a 4 or a 5 in those areas, respectively. (See Table 4.) Contractors appear to have very little frustration with specifications and details and with inspections, as consultants earning an unsatisfactory rating in those two categories totaled 5 percent and 9 percent, respectively). Consultants have areas that could use some improvement, according to their contractor counterparts. In the responding contractors' last experience with a consultant, timeliness was considered unsatisfactory by 11 percent, but this was a substantial improvement compared to the unsatisfactory rating of 24 percent in the 2003 study. While overall scores regarding communication were high - 65 percent gave consultants a 4 or a 5 in that area - 16 percent of contractors rated communication as unsatisfactory or poor. Follow-up is an area of frustration for 16 percent of contractors. The data demonstrates improvement by consultants with regard to change orders, but this still remains the highest area of frustration for contractors (19 percent rated consultant performance on change orders unsatisfactory, but this was down 9 points from the 2003 study).

Both groups were given a list of statements about the other and asked to rate their answers on a scale of 1 through 5, with 5 equating to "strongly agree," 3 to "somewhat agree," and 1 to "strongly disagree." When asked whether they agreed that "contractors approach the building owner about problems before discussing it with the consultant," 32 percent of consultants agreed and answered with a 4 or 5. (See Table 5.) Consultants are also concerned about contractors' independence; when asked whether they believed that "contractors are ‘in bed with' or otherwise committed to a particular manufacturer," 33 percent of consultants were in solid agreement, scoring the item with a 4 or a 5; another 34 percent agreed somewhat. Finally, 18 percent of consultants do not believe that "contractors appreciate the value brought to the job by the roof consultant," which certainly can negatively affect the relationship.

Contractors also have trust issues with consultants, but several areas showed marked improvement over the 2003 study. (See Table 6.) When asked if they agreed that "consultants purposefully find fault with the roofing contractor to demonstrate their value to the building owner," only 8 percent of the 2005 respondents agreed strongly with a 4 or 5 rating, compared to 37 percent in 2003. When asked if most consultants' knowledge of roof systems is outdated, 14 percent of contractors surveyed agreed with a ranking of 4 or 5, compared to 24 percent in 2003. Finally, when contractors were asked if they agreed with the statement "most roof consultants are ‘in bed with' or otherwise committed to a particular manufacturer," 21 percent of contractors were in solid agreement, compared to 37 percent in the 2003 study.

Contractors also have trust issues with consultants, but several areas showed marked improvement over the 2003 study. (See Table 6.) When asked if they agreed that "consultants purposefully find fault with the roofing contractor to demonstrate their value to the building owner," only 8 percent of the 2005 respondents agreed strongly with a 4 or 5 rating, compared to 37 percent in 2003. When asked if most consultants' knowledge of roof systems is outdated, 14 percent of contractors surveyed agreed with a ranking of 4 or 5, compared to 24 percent in 2003. Finally, when contractors were asked if they agreed with the statement "most roof consultants are ‘in bed with' or otherwise committed to a particular manufacturer," 21 percent of contractors were in solid agreement, compared to 37 percent in the 2003 study.

Consultants have significant issues in two aspects regarding cooperation with contractors. First, 53 percent of consultants do not believe that contractors provide timely schedules, drawings and submittals. (See Table 5.) Also, 30 percent of consultants surveyed do not perceive that contractors support the consultant's efforts when design parameters exceed the manufacturer's specifications (this was the same percentage of respondents as in the 2003 survey).

On the other hand, 29 percent of contractors would appreciate more help from consultants with justifying and pushing through change orders. (See Table 6.) However, when asked if "specifications provided by the consultant are useful and practical," 38 percent of contractors were in strong agreement, and another 48 percent agreed somewhat, while only 14 percent disagreed.

These are serious issues that contractors should focus on. Why? We know from a previous industry study with property owners that over half of their roof replacements go to the contractor that does the majority of their repair and maintenance. The contractor who can demonstrate to a consultant that they provide a responsive repair service and that they take after-project service seriously will likely get invited to participate in more bidding opportunities.

At the end of the day, the most successful companies first view their business through their customers' eyes. Identifying their needs (which means, in most cases, understanding their pain) and then demonstrating a solution is essentially the only way for companies and individuals to provide value.

Think about it this way: If you only share how good your value is, how good your products and services are, and how competitively priced you are, you're only achieving the status of an "acceptable commodity" in the eyes of customers. You have to go beyond expectations in order to add value. And, companies that add value are generally the most successful over time - for their owners, their employees and for their clients. There are two primary ways to go "beyond the expected" in this business. First, demonstrate a process that proves your unique ability and commitment to preventing problems before they happen. Second, demonstrate that you do things beyond the realm of a typical competitor.

How do you accomplish this? There are two basic elements: world-class processes and world-class client proposals.

How do you develop them? It's a comprehensive process, which typically involves a flow chart showing how things get done - and who does them. In sports, they call it a playbook. If your local high school football team didn't have a playbook, what do you think their results would be? So, if a roofing company doesn't have a playbook, do you think they could possibly be as effective and efficient as a competitor that did?

What's a world-class proposal do - and how is it different than the majority of proposals? Most proposals simply share what the company is going to do and how much it will cost. Simple. A view from the contractor's eyes. What's world class? Go back to the principles that a proposal must go beyond the expected in order to add value. It must not only demonstrate a good product and good service at a competitive price, it should exceed expectations by sharing how your company solves the client's problem - how it alleviates their pain. Therefore, it should include the criteria that customers need to solve their issues - and not only demonstrate that you solve those needs, but how you provide something extra as well.

Specifically, what might that include, based on this study? Well, we know that years of experience and client lists are considered very important for building owners choosing a contractor; how do you share those items on behalf of your company? We also know that there are healthy concerns by consultants relating to items including inspections, follow-through on punch lists, timeliness and crew management. How well have you documented and shared (even in the proposal as an addendum) your processes (your playbook) to prove to the consultant and the property owner your comprehensive capability and commitment to these important needs?

We know that consultants have trust issues with many contractors. How well have you answered these concerns in your proposal so that the consultant will not feel threatened that you will go to the owner directly with problems? How well have you proven your independence and commitment to helping assure the property owner you'll make the best and safest choice?

Frankly, if nothing else, you know from this study that consultants have a few critical concerns about contractors. Consultants point to the inability of contractors to provide timely schedules, the perceived lack of 24-hour emergency service, and concerns about service after the project is completed. If that's the case, isn't it easy to differentiate yourself from a typical contractor by including information on these topics in your proposals and bid packages? When you do, you'll likely get invited to participate in more bids and proposals - and you should generate more business, often at higher margins.

Business can seem very complicated, but it can also be pretty simple. The companies and individuals that excel at building trust and educating their customers generally earn more than their fair share. World-class processes will help you demonstrate trust. World-class proposals will help you educate the consultant and property owner, convincing them that using your company will result in superior value, with less risk.

When you're at a world-class level with your processes and proposals, your entire team will be more proud, more effective and more efficient. Most importantly, they'll generate world-class results.

In rivalries, the two sides don't like each other. And, that's not just true of the teams on each side of the rivalry - it's also true of the friends and fans that support them. Remember back to high school or college, and the feelings you had about rival sports teams? Think of professional sports, and there may very well be a team that you love to hate.

Rivals and their supporters often complain about each other. They say nasty things about each other. They have jokes that poke fun at each other. They compete with each other. However, sometimes, rivals even respect each other, and the competition creates a healthy tension that actually makes each side better. Anyone who has been exposed to the roofing industry knows that there has been a longstanding and often intense rivalry between roof consultants and roofing contractors. However, there is a legitimate question that should be asked: Is it a respectful rivalry that makes each group better, or is a bitter rivalry without respect in which both sides attempt to tear each other apart?

I feel personally blessed to be in the roofing industry. Over the past 10 years, I've met with literally thousands of contractors, consultants and property owners involved in the industry. During that time, I've witnessed an industry that is increasingly filled with people who contribute to "raising the bar," which results in an industry that we can all be even more proud of.

While the perception outside of this industry (and sometimes inside it, too) is that the roofing profession is "filled with convicts and scam artists," I'm continuously amazed at the passion and dedication of so many people I meet. Even with these improvements, I constantly hear examples of the rivalry between contractors and consultants and the impact it has on the industry.

A few years ago, I found kindred spirits interested in the relationship between contractors and consultants and the implications for the industry. Rick Damato, editorial director for Roofing Contractor magazine, and Kristen Ammerman, executive editor of Interface, a magazine published by the Roof Consultants Institute, both wanted to explore this issue, too. Comprehensive support came from a host of people from both magazines and resulted in a study that was conducted in 2003 to explore the perceived "feud" between contractors and consultants. The purpose of that study was to gain insights from contractors and consultants about how they feel about each other and suggest recommendations that might lead to improvements within the industry.

What did we learn from the 2003 study? In articles I wrote in both Roofing Contractor and Interface, I concluded from that initial research that there is a rivalry between consultants and contractors, but, in general, there is mutual respect between the two professions. Yes, there is evidence of unfair generalizations about one another's negative effect on the industry, but below the surface there is mutual respect. Despite minor annoyances, interdependence between the professions is evolving, and overall perceptions of the quality and value of both groups are generally favorable.

So Rick, Kristen and I talked about a year ago and wondered - have things changed? Is the continued growth, sophistication and consolidation of property management, distribution, consultants and contractors leading to greater interdependence between the contractor and consultant professions - or are things getting worse?

So, in the early fall of 2005, we decided to essentially repeat the initial 2003 study. We invited about 900 Roof Consultant Institute members and about 1,500 roofing contractors subscribing to Roofing Contractor to participate through a direct mail survey format.

The response rate was 28 percent for consultants and 16 percent for contractors, for an overall 20 percent response rate. By industry standards, this is a healthy response rate.

This article shares the results, analysis, and comparisons demonstrating trends from the previous study, as well as some thoughts and suggestions to help professional contractors improve their businesses.

Table 1. Attributes respondents ranked most important to consider when a building owner chooses a contractor (top three responses).

Advice for Property Owners

Contractors and consultants know each other well, and they know themselves well. We wondered: How did they think property owners should choose a contractor or consultant?Both consultants and contractors view experience as the most important factor for a building owner to consider when choosing a roofing professional. (See Tables 1 and 2.) Client lists and credentials are the next most important criteria suggested by respondents from both professions. In general, consultants view credentials as more important than contractors do when choosing a consultant; conversely, contractors put more weight in client lists overall than consultants do. These attitudes are relatively similar to those reflected in the 2003 study.

When asked what attribute was the most important factor building owners should consider when choosing a contractor, 51 percent of consultants and 57 percent of contractors responding to the survey point to experience as the most important criterion. (See Table 1.) Both consultants (17 percent) and contractors (36 percent) believe the contractor's client list is the second most important attribute to consider when choosing a contractor. Credentials emerged as the third most important factor for both groups, with 12 percent of consultants and 4 percent of contractors responding that credentials were the most important attribute for building owners to consider.

Table 2. Attributes respondents ranked most important to consider when a building owner chooses a consultant (top four responses).

Conversely, when asked what attribute was the most important factor for building owners to consider when choosing a consultant, experience again emerged as the most important factor - although, in this case, experience was split into two categories: "years of experience as a qualified roof consultant" and "past experience as a roofing or building contractor." Combining the totals for both of these responses, 51 percent of consultants and 68 percent of contractors believe that experience is the most important criterion to consider when choosing a consultant. (See Table 2.) However, consultants believe that experience as a roof consultant was a more important factor (38 percent), while contractors believe that a consultant's past experience as a contractor was more crucial (40 percent). Credentials are more important to consultants (22 percent) than contractors (12 percent). A minority of respondents from both professions viewed client lists as the most important criterion (14 percent of consultants, 16 percent of contractors).

Table 3. Consultants were asked to rate the last contractor with whom they completed a project.

How Do the Groups Rate One Another?

Consultants were asked to rate the performance of the last roofing contractor they worked with in several categories on a scale of 1 to 5, with 1 equating to "poor" and 5 to "outstanding." (See Table 3.) While the overall results were favorable, and many areas saw improvement over the 2003 survey, the study reveals there is still some room for improvement.Consultants believe that contractors perform best on attention to details in specifications (64 percent of consultants gave contractors a 4 or 5 in this area). Performance by contractors on change orders was viewed as unsatisfactory or poor by 14 percent of consultants, who gave contractors a 1 or a 2 in this category. The consultants' last experience with contractors related to follow-through on punch lists was considered unsatisfactory by 19 percent, but this figure was down from 21 percent in the 2003 study. Seventeen percent of consultants believe contractors do not manage their crews well, but this was an improvement compared to the 2003 study, where 21 percent found crew management unsatisfactory. The study shows the biggest areas for improvement by contractors are in timeliness (24 percent gave contractors a 1 or 2 in this area, compared to 29 percent in 2003) and contractor quality of inspections (18 percent received a 1 or a 2, an improvement of 6 percent versus 2003 statistics).

Table 4. Contractors were asked to rate the last consultant with whom they completed a project.

When contractors were asked to rate the last consultant they worked with, consultants received the best ratings in communications with contractors and in specification and details, with 65 percent and 64 percent receiving a 4 or a 5 in those areas, respectively. (See Table 4.) Contractors appear to have very little frustration with specifications and details and with inspections, as consultants earning an unsatisfactory rating in those two categories totaled 5 percent and 9 percent, respectively). Consultants have areas that could use some improvement, according to their contractor counterparts. In the responding contractors' last experience with a consultant, timeliness was considered unsatisfactory by 11 percent, but this was a substantial improvement compared to the unsatisfactory rating of 24 percent in the 2003 study. While overall scores regarding communication were high - 65 percent gave consultants a 4 or a 5 in that area - 16 percent of contractors rated communication as unsatisfactory or poor. Follow-up is an area of frustration for 16 percent of contractors. The data demonstrates improvement by consultants with regard to change orders, but this still remains the highest area of frustration for contractors (19 percent rated consultant performance on change orders unsatisfactory, but this was down 9 points from the 2003 study).

Table 5. Consultants were asked to rate how they agreed with statements about contractors.

Respect Is There, But What About Trust?

While there is a reasonable degree of respect by both contractors and consultants for the other group, the core of a relationship is trust, and based on the results of survey questions designed to explore how much the two groups trust each other, there again seems to be ample room for improvement.Both groups were given a list of statements about the other and asked to rate their answers on a scale of 1 through 5, with 5 equating to "strongly agree," 3 to "somewhat agree," and 1 to "strongly disagree." When asked whether they agreed that "contractors approach the building owner about problems before discussing it with the consultant," 32 percent of consultants agreed and answered with a 4 or 5. (See Table 5.) Consultants are also concerned about contractors' independence; when asked whether they believed that "contractors are ‘in bed with' or otherwise committed to a particular manufacturer," 33 percent of consultants were in solid agreement, scoring the item with a 4 or a 5; another 34 percent agreed somewhat. Finally, 18 percent of consultants do not believe that "contractors appreciate the value brought to the job by the roof consultant," which certainly can negatively affect the relationship.

Table 6. Contractors were asked to rate how they agreed with statements about consultants.

What About Cooperation?

We improve our businesses by understanding where and how others that depend on us are frustrated with what they perceive is the quality of our cooperation - and then demonstrate our ability and commitment to being cooperative and getting the job done right.Consultants have significant issues in two aspects regarding cooperation with contractors. First, 53 percent of consultants do not believe that contractors provide timely schedules, drawings and submittals. (See Table 5.) Also, 30 percent of consultants surveyed do not perceive that contractors support the consultant's efforts when design parameters exceed the manufacturer's specifications (this was the same percentage of respondents as in the 2003 survey).

On the other hand, 29 percent of contractors would appreciate more help from consultants with justifying and pushing through change orders. (See Table 6.) However, when asked if "specifications provided by the consultant are useful and practical," 38 percent of contractors were in strong agreement, and another 48 percent agreed somewhat, while only 14 percent disagreed.

Table 7. Consultants were asked to rate how much they agreed with statements about contractors.

Contractor Services - Perception of Voids

Sometimes, it doesn't matter if it's true or not. According to the survey, many consultants (35 percent) believe that contractors do not provide 24-hour repair service. (See Table 7.) Worse, the majority of consultants (52 percent) are dissatisfied with contractors "after-project service," - and this figure is similar to the response in the 2003 study (53 percent).These are serious issues that contractors should focus on. Why? We know from a previous industry study with property owners that over half of their roof replacements go to the contractor that does the majority of their repair and maintenance. The contractor who can demonstrate to a consultant that they provide a responsive repair service and that they take after-project service seriously will likely get invited to participate in more bidding opportunities.

Table 8. Contractors were asked to rate how much they agreed with statements about consultants.

Gauging The Value of Consultants

The contractors surveyed believe that consultants bring value to the industry - and this perception has improved somewhat since the 2003 study. When asked if "having a consultant on the job makes the quality increase," 37 percent of contactors responded affirmatively with a 4 or 5 rating, while only 21 percent disagreed. (See Table 8.) When asked whether "consultants add value to the project for the building owner," only 9 percent disagreed. Interestingly, when asked if they thought "design specifications from consultants are better than design specifications from architects," 46 percent agreed with a rating of 4 or 5, and only 22 percent of respondents disagreed.The Implications for Progressive Contractors

Fundamentally, perceptions are realities. Sometimes it doesn't matter if you have 24-hour emergency service, and it doesn't matter if you are comprehensively prepared and committed to post-project service; if the consultant doesn't believe it, it doesn't exist. Remember, consultants represent the eyes and ears of a growing number of property owners.At the end of the day, the most successful companies first view their business through their customers' eyes. Identifying their needs (which means, in most cases, understanding their pain) and then demonstrating a solution is essentially the only way for companies and individuals to provide value.

Think about it this way: If you only share how good your value is, how good your products and services are, and how competitively priced you are, you're only achieving the status of an "acceptable commodity" in the eyes of customers. You have to go beyond expectations in order to add value. And, companies that add value are generally the most successful over time - for their owners, their employees and for their clients. There are two primary ways to go "beyond the expected" in this business. First, demonstrate a process that proves your unique ability and commitment to preventing problems before they happen. Second, demonstrate that you do things beyond the realm of a typical competitor.

How do you accomplish this? There are two basic elements: world-class processes and world-class client proposals.

How do you develop them? It's a comprehensive process, which typically involves a flow chart showing how things get done - and who does them. In sports, they call it a playbook. If your local high school football team didn't have a playbook, what do you think their results would be? So, if a roofing company doesn't have a playbook, do you think they could possibly be as effective and efficient as a competitor that did?

What's a world-class proposal do - and how is it different than the majority of proposals? Most proposals simply share what the company is going to do and how much it will cost. Simple. A view from the contractor's eyes. What's world class? Go back to the principles that a proposal must go beyond the expected in order to add value. It must not only demonstrate a good product and good service at a competitive price, it should exceed expectations by sharing how your company solves the client's problem - how it alleviates their pain. Therefore, it should include the criteria that customers need to solve their issues - and not only demonstrate that you solve those needs, but how you provide something extra as well.

Specifically, what might that include, based on this study? Well, we know that years of experience and client lists are considered very important for building owners choosing a contractor; how do you share those items on behalf of your company? We also know that there are healthy concerns by consultants relating to items including inspections, follow-through on punch lists, timeliness and crew management. How well have you documented and shared (even in the proposal as an addendum) your processes (your playbook) to prove to the consultant and the property owner your comprehensive capability and commitment to these important needs?

We know that consultants have trust issues with many contractors. How well have you answered these concerns in your proposal so that the consultant will not feel threatened that you will go to the owner directly with problems? How well have you proven your independence and commitment to helping assure the property owner you'll make the best and safest choice?

Frankly, if nothing else, you know from this study that consultants have a few critical concerns about contractors. Consultants point to the inability of contractors to provide timely schedules, the perceived lack of 24-hour emergency service, and concerns about service after the project is completed. If that's the case, isn't it easy to differentiate yourself from a typical contractor by including information on these topics in your proposals and bid packages? When you do, you'll likely get invited to participate in more bids and proposals - and you should generate more business, often at higher margins.

Business can seem very complicated, but it can also be pretty simple. The companies and individuals that excel at building trust and educating their customers generally earn more than their fair share. World-class processes will help you demonstrate trust. World-class proposals will help you educate the consultant and property owner, convincing them that using your company will result in superior value, with less risk.

When you're at a world-class level with your processes and proposals, your entire team will be more proud, more effective and more efficient. Most importantly, they'll generate world-class results.

The Roofing Contractor survey,

"Study of Relationships Between

Roofing Contractors and Consultants," is available for purchase for $250.

For more information, contact

Cory Maxwell at 248-244-6415.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!