Three Surprising Statistics That Could Save Your Roofing Company

As roofing contractors and business owners, we are constantly exposed to a variety of risks. Risks that would keep an outsider awake most nights. We have training, policies and systems to overcome so many risks that we tend to get lulled into taking them for granted and perhaps gain a false sense of security.

Our contracting businesses are exposed to potentially huge liabilities, yet a part of our company culture is to professionally manage these obstacles that are put in the forefront of all our management and workers every single day. Think of safety — outsiders just see the lawsuits and high worker-compensation rates our industry pays. We recognize and manage this risk as part of our day-to-day business.

When exiting, our risks are more prevalent than ever, but insidious. We take for granted that we will have a buyer just waiting in the wings. Whether the buyer comes from the outside, management or family, we then need to be certain that we can harvest enough sales proceeds to meet our post-exit financial goals.

The turn of the last decade has brought us many financial hardships and company closings within all industries and communities. We’ve all witnessed successful enterprises, led by experienced baby boomer owners, fumble the ball in the red zone of their career only to leave a mess for their spouses, family, company and community.

You may ask, what is the main cause of failure? The U.S. Small Business Administration (SBA) found many companies haven’t planned properly for ownership changes.

“At any given time, 40 percent of U.S. businesses are facing the transfer of ownership issue,” the SBA states on its website. “The primary cause for failure … is the lack of planning.”

I’ll share three business statistics you need to memorize to understand your risk if you ever intend to cash out.

Seventy percent of your wealth is trapped inside your illiquid business. Because this number is so large, how do you intend to beat these odds? How will you cash out, retire and not run out of money or alter your post-exit lifestyle?

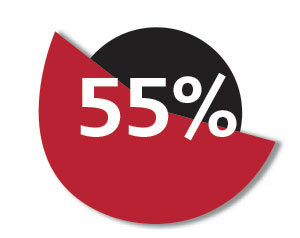

Fewer than thirty percent of businesses ever sell or transfer. According to the Family Firm Institute — an international association for professionals servicing family-owned enterprises reports:

- Seventy percent fail to transfer to the second generation.

- Ninety percent fail to transfer to the third generation.

These are onerous statistics that you can’t afford to ignore for the benefit of your family, management and employees.

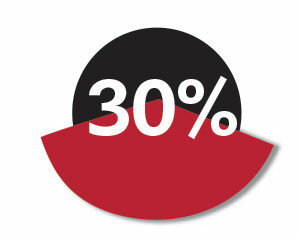

If you are one of the lucky ones to cash out, then you have the welcoming hands of Uncle Sam waiting for his “fair share” of your harvest. This can range from zero to over 55 percent:

- Around zero percent if you have a great advisor, not a good adviser

- Around 30 to over 55 percent if you have a conventional adviser

Why am I slamming traditional advisers? Listen to my actual story.

After retiring, I went back to school for two years to become certified in my new career as an exit planner. It was then that I discovered that our company advisers, for whom we shared over thirty years of experiences together, provided us with “cookie cutter” advice. This cookie-cutter approach cost our team millions of dollars in unnecessary taxes. If I only knew then… what I know now.

Believe me, I found out the hard way that you don’t know…what you don’t know.

But I was just one of three owners of a 200- employee company then, and we were not specialists in exit planning and succession. The good news is that I’m continually learning new strategies to help owners down the exit path and that gives me renewed energy and passion for an ‘old guy’ approaching seventy.

Even though my team was one of the lucky ones that cashed out and successfully passed the baton to a fourth-generation management team, there was a lot to learn. Each day, my goal is to help business owners by speaking to audiences and publishing as many articles as possible to protect them from repeating my costly mistakes.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!