Going the Wrong Direction

MRA Calls for Increased Action From Government, Utility Companies To Spur Energy Efficiency Improvements

The demand for energy efficiency is not being met with proper support from governmental bodies

The start of fall is typically the time to prepare for colder weather, but with a changing climate, many regions are now experiencing hotter weather patterns that stretch far longer into the year, making home air conditioning systems not just nice to have, but a necessity for families everywhere.

That increasing demand is why the Metal Roofing Alliance (MRA) is calling on federal, state and local governments and utilities to take more action to help incentivize homeowners to make smart, energy efficient decisions when it comes to home building and remodeling practices. While some utilities continue to offer local rebates to help encourage homeowners to make more energy efficient choices, many of the federal tax credits and incentives that used to be offered through programs such as ENERGY STAR have been revised, reduced or in some cases, are being phased out completely by the end of 2021.

Unfortunately, the lack of strong, ongoing incentives to help encourage more efficient practices is coinciding with a massive spike in demand for residential cooling throughout the country and an urgent need to reduce fossil fuel reliance. As reported by Yale School of the Environment, as temperatures climb, demand for home air conditioning in the United States is expected to surge 59% over the next 30 years, increasing emissions, straining power grids, and financially burdening millions of middle- and low-income American families who already struggle to pay utility bills.

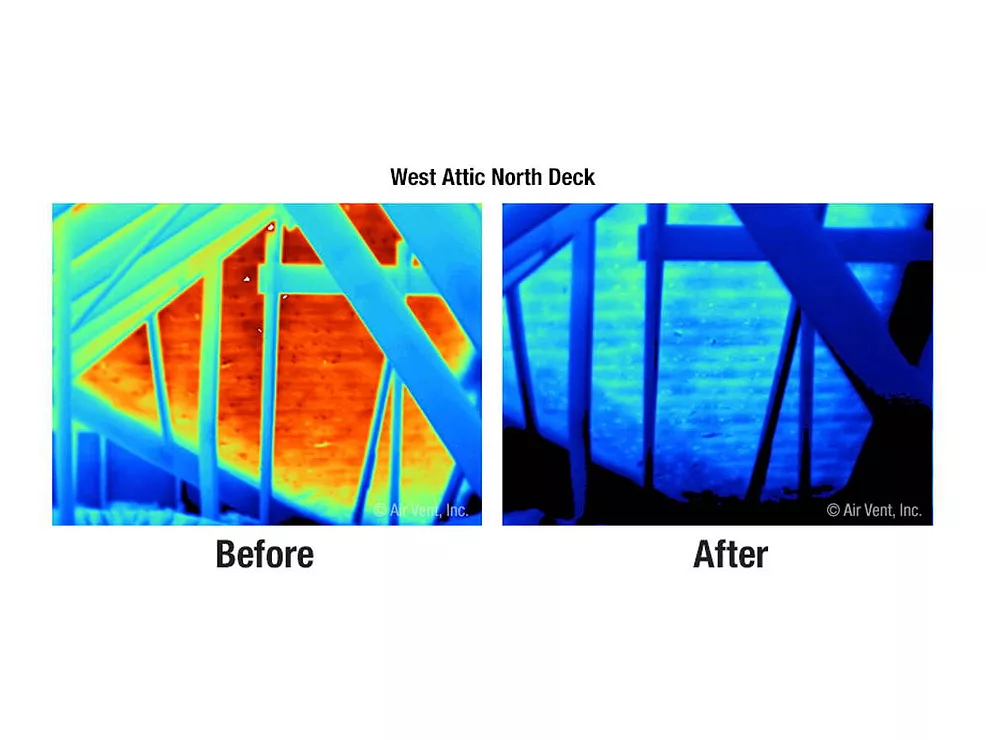

Cool metal roofs can reduce air conditioning usage by 10 to 15%

Cool metal roofs can reduce air conditioning usage by 10 to 15%

Better residential building and remodeling practices designed to save energy — such as choosing highly efficient, better performing quality metal roofs — could help offset those impacts significantly, according to the MRA. Cool metal roofs offer high solar reflectance and help emit heat gain, reducing the amount of air conditioning needed by as much as 10-15%, and the Environmental Protection Agency estimates that an ENERGY STAR-qualified roof can lower roof temperatures by as much as 50 degrees Fahrenheit. In the past, federal incentives have recognized the powerful energy savings potential of quality metal roofs that can emit as much as 85% of solar heat gain to help keep homes cooler. Yet federal tax credits for cool roofs are no longer in place to assist homeowners who are looking to make a more efficient and sustainable choice.

Encouraging homeowners to improve home insulation and consider installing residential solar systems would also make a significant difference in reducing the energy and environmental burden caused by the increasing use of home air conditioning. But these types of investments, while they help lower costs significantly over the long run, often carry a higher upfront price tag. That makes them out of reach for many homeowners, and why programs that help alleviate upfront investments in better performing, more efficient improvements are so essential.

There’s a trifecta of forces happening: hotter weather, the need to reduce energy use to help combat climate change, and alleviate the financial impacts on families not just today, but over time. Incentive, credits and rebates are important because they can help give homeowners an avenue towards making investments that address these issues over the long run. More utilities, as well as federal, state and local governments, would be well-served to consider programs designed to help encourage these practices as much as possible.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!