ARMA Q2 2022 Shipment Report Shows Increases Despite Inflation, Shortages

The Weitzman Office by Nations Renovations in Dallas received an Honorable Mention in the 2021 ARMA Excellence awards. Photo: Swivel Interactive.

Shipments of various types of asphalt roofing products have risen in the past quarter, sparking hope that sectors of the roofing industry might be turning a corner on supply shortages.

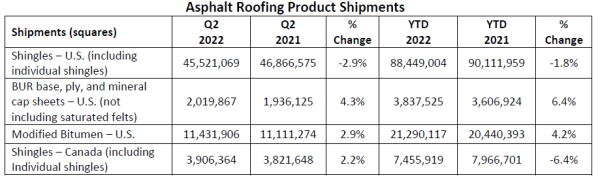

According to the latest Quarterly Product Shipment Report from the Asphalt Roofing Manufacturers Association (ARMA), shipments of shingles, built-up roof (BUR) and modified bitumen products have all risen compared to the first quarter of 2022, continuing a trend seen last quarter.

Like Q1, though, comparing this quarter’s data to the same time last year reveals that those improvements might be incremental.

Residential and Commercial Gains

Information used in the ARMA report is collected from participating manufacturers by an independent third party. When comparing Q2 2022 to Q1 2022, the following data emerges (reported in squares):

- U.S. Shingles: 45.5 million, up 6%

- BUR Base, Ply and Mineral Sheet Caps: 2 million, up 11.1%

- Modified Bitumen: 11.4 million, up 15.9%

- Canada Shingles: 3.9 million, up 11.1%

While not as large as the increases seen from Q4 2021 to Q1 of 2022, the data hints at improvements for both residential and commercial roofing. Even when comparing Q2 2022 to Q2 2021, the improvements are smaller, but still there: a 4.3% increase for BUR and 2.2% increase for modified bitumen.

The same can’t be said for products mainly used in residential roofing. U.S. shingle shipments decreased by 2.9% when comparing Q2 2022 and Q2 2021, while shingle shipments in Canada went up by 2.2%.

ARMA’s report also examines year-to-date shipments. BUR shipments in 2022 are outpacing those in 2021, having increased by 6.4%. Modified bitumen shipments are also performing better by 4.2%. Shingle shipments in both the U.S. and Canada are down by 1.8% and 6.4%, respectively.

Inflation, Shortages and War

This past quarter is one marked by inflation, rising construction prices and supply shortages, some of which are exasperated by the ongoing Russia-Ukraine War. Commercial roofing has been hit harder than residential, says McKay Daniels, National Roofing Contractors Association (NRCA) CEO, and the inventory normally built up by summer surges simply isn’t there.

“We’re definitely not monolithic. Commercial is having a tougher time than residential as is the nature of the roofing system. If you’re missing one component you don’t have a roof system so the complexity of it doesn’t help,” he said.

Construction input prices are up 20.1% from a year ago, while nonresidential construction input prices are 20.3% higher, according to the latest information from the U.S. Bureau of Labor Statistics. Associated Builders and Contractors (ABC) Chief Economist Anirban Basu said that despite these cost increases, this may be the worst of it.

"It’s no secret that contractors and their customers have been walloped by massive increases in construction materials prices,” said Basu. “That inflation continued through June, as reflected in the decline in profit margin expectations seen in the most recent reading of ABC’s Construction Confidence Index. But more recently, key commodity prices have declined, so it may be possible we have achieved peak inflation."

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!