Solar Special Section

Solar and Roofing: Current Trends and Looking Ahead

Solar Surges in Multiple Roofing Markets – are Roofers Ready?

In recent years, we’ve witnessed a rise in the popularity of solar in both the residential and commercial roofing industries. A 2023 study by Allied Market Research found the global solar sector on track to generate nearly $241 billion by 2031, a dramatic increase over the $59 billion recorded globally in 2021.

Specifically in the U.S., growth percentages are trending similarly, with estimates of the market valuing more than $900 million by 2025. What does this mean for those of us in the industry?

It’s clear the demand for solar is trending upward, so it’s crucial to remain knowledgeable on all facets of the ever-changing equipment. As the solar market evolves, we expect positive advances in panel and system technology, installation processes and more substantial benefits offered by state and federal governments in the form of tax credits, to name a few.

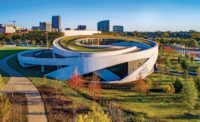

With a rising demand for solar panels, installation processes are becoming routine for roofers and have progressed with modern technology.

Improved Technology and Reduced Costs

Increased interest in solar continues to spur development in solar technology, specifically in designing the solar system's photovoltaic sheets. With modern advancements, we better understand how solar cells capture light, allowing improved development in the materials used alongside the cells to transmit the captured light to its final destination, such as lighting fixtures within a home or business.

Today, the most common material used in solar systems is silicon, reportedly found in 95% of models sold in the U.S. The lattice design of silicon atoms promotes increased efficiency as the solar cells and panels capture light, and the sheer abundance of silicon contributes to an overall reduced cost.

These attributes have contributed to greater accessibility of solar systems for homeowners and business owners, and we anticipate this trend of increased efficiency and decreased costs to continue in the future.

Another rising trend is the concept of “flexible panels,” an emerging technology allowing system installation on various surfaces, including cars and windows. Research is still largely underway, but recent developments have shown that flexible panels are inherently lighter, giving way to more diverse install locations.

These flexible panels are also designed with thinner materials that can perform in high-heat environments. We expect continued development into increased efficiency and lowered costs of flexible solar panels to promote even greater accessibility.

Design and Installation Improvements

As panel technology improves, so do the system design and installation processes. With lighter-weight systems and faster technologies requiring less wiring and hardware installation, the turnaround time for homeowners and business owners has decreased significantly in recent years.

Before installation can begin, though, we know system design is a critical step in the process. Design tools such as Helioscope, Aurora or OpenSolar allow us to simulate different production scenarios for panel locations. With this technology, we, as professionals, are best equipped to ensure accurate placement and maximized panel efficiency for homeowners and business owners.

With a rising demand for solar panels nationwide, installation processes have become somewhat routine for roofers and have progressed with modern technology. As trends in the roofing industry change, such as introducing new shingle materials, it will be critical for solar experts to note and identify necessary changes to solar system installation processes and requirements. Most recently, we’ve seen trends in impact-resistant shingles and metal roofs compatible with solar panels.

As system development progresses, we anticipate a reciprocated advancement in design and installation to keep solar at the cutting edge of roofing technology for years.

State and Federal Tax Credits and Regulations

We know a significant incentive for homeowners and business owners when deciding on solar panels is the variety of available tax credits. For residential owners, the federal residential solar energy tax credit can be claimed on federal income taxes for a percentage of the cost of a solar system, with solar systems installed from 2022-2032 eligible to receive a 30% tax credit.

Additionally, if a homeowner or business chooses to use domestically sourced goods for their roofing project, they may be eligible to receive additional credits. Many states and local municipalities also offer solar incentives that can be combined with federal tax credits.

For commercial properties, the investment tax credit, or ITC, reduces the federal income tax liability for a percentage of the cost of a solar system installed during the tax year. The production tax credit, or PTC, is a per kilowatt-hour tax credit for electricity generated by solar and other qualifying technologies for the first 10 years of a systems operation. The PTC reduces a business’s federal income tax liability and is adjusted annually for inflation.

With recently renewed legislation extending the federal tax credit into 2034, this will remain an important trend in the solar industry looking into the following year.

Our responsibility as field experts is to remain informed on new technologies and trends to ensure satisfaction and peace of mind for our customers. Solar will remain a dominant force as we look ahead in the roofing industry and will continue to develop and change over time as efficiencies are improved.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!