Sustained Strategy: Tecta America's Rise to the Top

In a market swirling with private equity cash, Tecta America continues to draw leading roofing contractors into the fold through a proven acquisition process.

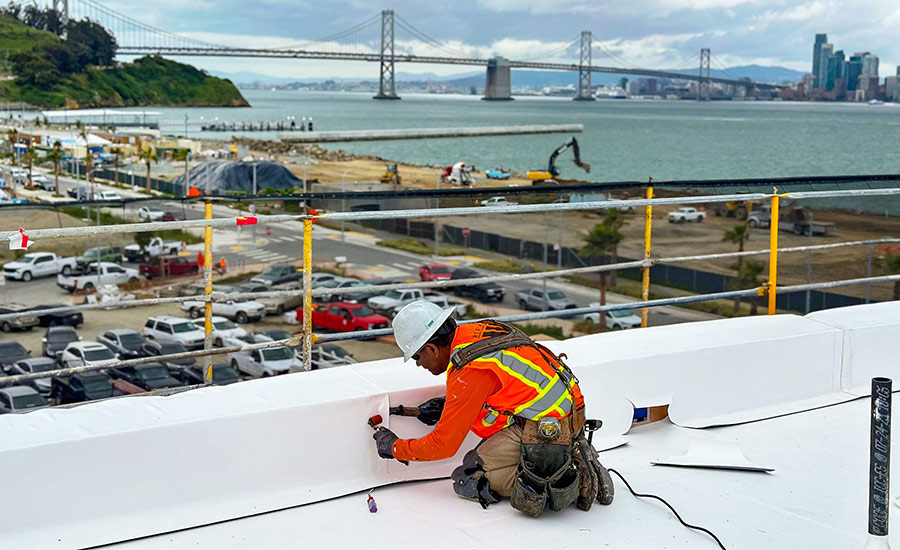

Photos courtesy of Tecta America.

By most measurable standards, Tecta America is having another great year in the roofing business. The annual revenue reported for 2023 was $1.4 billion, placing the company atop RC’s 2024 Top 150 List. The number of employees has grown to 4,400, and they are consistently delivering high-quality work, including several projects and a growing list of impressive industry awards.

Part of the winning formula that’s worked for the Illinois-based national commercial contractor for more than two decades is baked in by bringing top-notch roofers aboard. It’s part of the company’s DNA, considering it began when the leaders of nearly a dozen roofing contractor companies partnered with a purpose — to bring the best roofers together to learn, share and replicate best practices while offering a national footprint.

In its first two decades, the company grew from 17 to 75 locations across the country through a deliberate yet aggressive growth strategy that never seems to slow.

One could argue that Tecta was a pioneer in the roofing acquisition space, going through a series of private equity partnerships, including the 2018 purchase by Altas Partners. Since then, Tecta’s trajectory soared through acquisitions of well-established and successful roofing companies, including century-old RSS Roofing Services & Solutions in St. Louis (2018); Empire Roofing in Fort Worth, Texas (2021); Mahaney Roofing in Wichita, Kan. (2022); CE REEVE Roofing in Indianapolis (2023), and the Eberhard Companies based in Van Nuys, Calif., and Las Vegas earlier this year.

RC recently caught up with CEO Dave Reginelli and Mark Santacrose, Tecta’s executive chairman and former president, to put some of their success into perspective with today’s volatile marketplace and take a closer look at the strategy continuing to put them at the top of the commercial roofing profession.

Congratulations on being at the top of our Top 100 List for 2024. How is your year going?

Dave Reginelli (DR): It’s gangbusters right now, we’re very busy. After supply chains loosened up last year, we’re in full swing and back to normal, hitting on all cylinders. Our backlog … I won’t say it’s at record level, but it’s very close. By pre-COVID historical standards, we are still sitting on more months of supply of backlog than before COVID.

How would you assess the state of the roofing industry right now? And Tecta?

DR: There are some segments that did slow down a bit, as you'd expect, like the interest rate-sensitive ones. Most industries that we provide services to, like heavy industrial, hospital and institutional facilities, are still strong right now.

Mark Santacrose (MS): Even after all these years,I remain quite impressed with how Tecta is doing. From a financial standpoint, things are really strong, and our people are really motivated. Our culture is really strong. We are very active in the market and looking at potential acquisitions. We are talking to folks all the time.

A roofing contractor with Tecta America puts the finishing touches on a TPO installation job in San Francisco. The commercial roofer’s national footprint now spans from the West to East coast.

Tecta continues to make bold acquisitions. How is the climate different from a year or two ago?

DR: Our track record of successful acquisitions over the past 24 years has given us credibility when talking to owners looking to sell. There is a lot of activity and a lot of interest in the market right now. Private equity has moved into the roofing space in a big way and is very active, though surprisingly, few deals are actually getting done. The few deals that are getting done are taking a long time to close.

We’ve increased our ability to talk to more people, so I’d say we’re probably having twice as many conversations as we have over the years. We have a proven and predictable acquisition model and process. So, we’re talking to a lot more people on the front end, but you know what gets through our funnel? It’s pretty much the same high-quality companies that we’re always interested in.

MS: I started at Tecta in 2000, and at the time, there were private equity-led consolidation efforts that were going on. And here we are back in a similar time again. I’d say there's a tremendous amount of activity from a whole range of private equity firms. A few of the firms doing deals seem well capitalized but that is not the case for most of them. It’s a scattered environment out there. Lots of action but inconsistent capabilities.

Why is there so much private equity interest in roofing right now?

MS: The people driving private equity decisions today … don't really understand that most of the private equity firms involved in the industry in the early 2000s did not turn out well. In fact, we acquired what was left of a number of them. The memories of the industry and the investment world are relatively short.

It's also no secret that we've grown significantly and created a good amount of value for our investors and our employees. And so people see that and think, “Let's give it a try.”

Tecta also had challenges along the way. What stands out in your mind?

DR: Tecta went through some tough times with our first private equity owner, and as a result, it solidified who we are today. And that's what we've stuck to, that business model. We give our field leaders tremendous autonomy to run their businesses like they are still the owners and they thrive in that environment. They don’t want to be told what to do by someone six states away.

We view private equity more as financing for our hard deals. So, when someone sells to someone like us, they sell to a strategic buyer who truly understands the industry. Today, I think there’s a new rush of money into the industry, but understanding what a contractor goes through on a day-to-day basis is really important, and it’s a lot different than a lot of other industries.

How have you learned to help roofing contractors through acquisitions and growth?

DR: We understand the business, so everything we do at the corporate level during an acquisition is designed to make the contractor’s life easier because we know they already have a difficult job. All the things they have to deal with, whether it’s compliance matters, funding, banking, medical coverage, all the various things that take time away from the core business of roofing. That’s the real business; everything else is a distraction, so our model has really helped these contractors. I also think others have seen our success and are trying to replicate it, but it took us 20-plus years to get there.

MS: I'll just add that it's not because we're all that smart. We've made mistakes. We've done lots of things that we regret. We've got lots of scars on our back, which is a great education. And you know, we've tried lots of different things, but we’ve never really gotten away from that core model of the local roofing contractor is really the most important part of the foundation. Everything else we do is to try to add value to them.

The versatility of roofing contractors working for Tecta America allow the company to install virtually any type of roof on any commercial project, including the recently-completed Top Golf Fishers in Indianapolis.

How successful have Tecta acquisitions been and why?

DR: We’ve done over 51 deals since 2000 and 31 in the last 10 years, and really we’ve only had one mediocre outcome. We don’t look for sellers; we look for partners. That’s a key point to remember. This approach has helped us to grow to over 60 business units and 100 locations across the U.S. since we were founded. Our Mission Statement is unique — it’s quite simple, “To be the best place to work in the industry.” That’s it. And we work extremely hard every single day to make that a reality.

What is the due diligence process like?

DR: Our due diligence involves getting to know the key people in the organization and making sure that it’s a good fit. As you know, this is a people business at its core. So, we approach every acquisition with an eye on making sure that all of the people are taken care of. We hire every single employee when we buy a company and want them to do the same or better under Tecta as they did before.

Also, our approach to working with each business unit is different as well. We use an “opt-in” model on most everything we do, instead of “push-down,” meaning that the local business isn’t mandated to all of a sudden change how they run their entire business once they are part of the Tecta family.

How is Tecta’s acquisition strategy different?

DR: Think of us as a strategic buyer rather than a financial buyer like private equity. I think the difference is that they have to go through a lot of the learning that we’ve got under our belt. We’ve kind of seen it all as far as how companies are successful and how they fail. As we have said, with our experience making more acquisitions in this industry than anyone else, we’ve learned what works best for the owners and employees of the companies that we are buying. Many owners looking to sell want to ensure that their company will be in good hands moving forward. They see that we are in it for the long term and that we are the best company to partner with.

What scares you about the frenzy of acquisitions in the marketplace?

MS: A challenge that folks new to the industry are going to have — folks that want to make a bunch of acquisitions and then dissolve the business but don’t do the hard work of integration, getting people on the same systems and set up to grow as far as they want to grow.

Tecta America has more than 4,400 employees nationwide that helped generate more than $1.4 billion in roofing revenue in 2023, topping RC’s Top 100 List yet again.

How has Tecta responded to the increased M&A activity in roofing recently?

MS: We have done quite a lot to expand our efforts internally to do even more acquisitions. We hired John Massarelli in the last year to spearhead our efforts in the market. John has been in the industry for almost 20 years and brings a unique skill set to the table, as well as a vast network across the entire industry. We’ve known John for many years, and he fits our culture extremely well. We recently promoted Kevin Palmer to president to assist Dave in running the day-to-day business. Kevin was one of our most successful operating unit presidents, and we are thrilled to have him join the corporate team and help support our field leaders. Kevin’s promotion will also allow Dave to become more active along with John to find, close and develop acquisitions for years to come.

DR: Our financial team, led by our CFO Marc Benson, is super strong. I don’t think that there is a team anywhere that has looked at more contractors in this industry than Marc and his team. We are lean here, but that allows us to move fast if needed. In fact, we feel that we have the ability to close deals faster than anyone in the market, and we see that as a big competitive advantage.

When will the activity end, or at least slow down?

MS: It dries up with the returns. If returns continue to be strong, it’ll continue to be strong. They can also take their money to other industries or investment opportunities. When the firms that get in have to exit or run out of money, which is the case with a couple of them, especially in a tougher financing market, they’re no longer able to get transactions done. Then we’ll find out when it’s over.

DR: If there are some bad outcomes, it’ll change fast. It will come in quickly and go out just as quickly. The real risk of the contractor selling is that’s their legacy; often, that’s their family name. They built their business with their people, putting it all into an unknown environment.

The award-winning roof atop Las Vegas’ Allegiant Stadium, site of Super Bowl LVIII last February, was installed by Eberhard Southwest Roofing—acquired by Tecta America earlier this year.

What are you proud of?

MS: One of our core original contractors, John Miller, established a scholarship program when he retired that’s available to employees or their children who want to go to college. Last year, we surpassed over $1 million in total scholarships given out. We are extremely proud to continue that legacy.

What’s next for Tecta America?

DR: Many companies are considering a strategic partnership, and the pipeline’s never been bigger for us. We thrive on bringing great contractors in. It’s exciting for them, for us and for our extended family of people. I’d say it’s never been more active than now, and we’re going to be focused on that, and I think 2024 is going to be better than 2023. We’ll see how 2025 develops, but I think all signs are positive right now.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!